Breaking Down Merchant Cash Advances: A Transparent Approach with 3BAdvance.com

At 3BAdvance.com, we believe in empowering businesses with clear and accessible financing solutions. We understand that navigating the world of business funding can be complex, especially when considering options like Merchant Cash Advances (MCAs). Unlike traditional loans, MCAs operate differently, and it’s crucial to understand these nuances. This guide breaks down MCAs, focusing on transparency and how 3BAdvance.com prioritizes clarity for our clients.

What is a Merchant Cash Advance (MCA)?

A Merchant Cash Advance provides a lump sum of capital upfront in exchange for a percentage of your future credit and debit card sales. This offers a quick and flexible funding option, particularly beneficial for businesses with consistent card transactions. Think of it as a way to unlock your future sales potential and use those funds to address current needs.

- Advance Amount: The agreed-upon amount of capital your business is approved for.

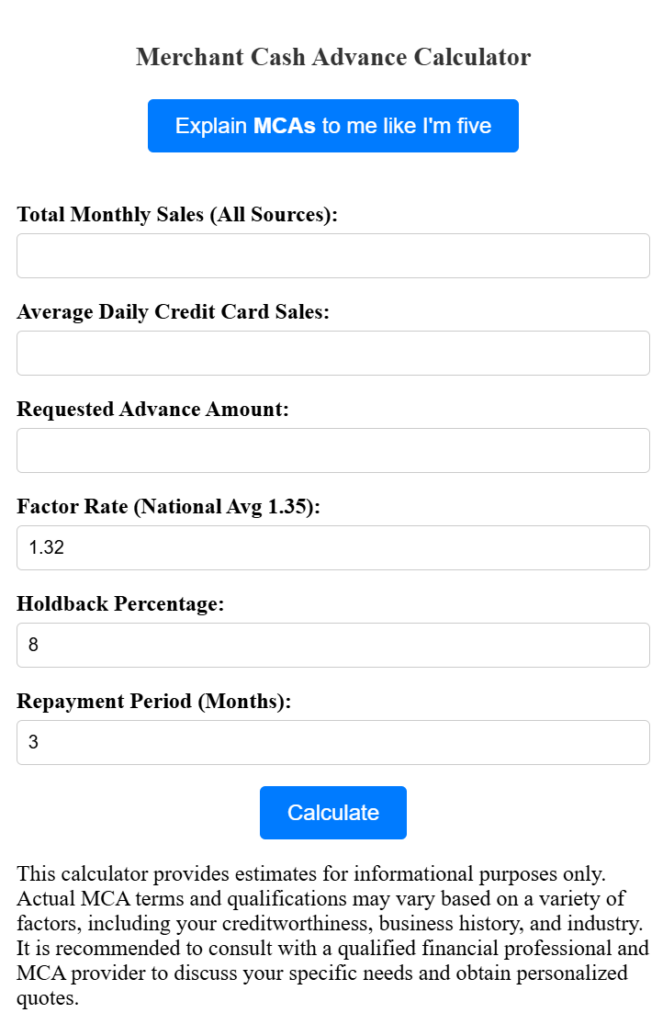

- Factor Rate: This is the cost multiplier applied to the advance amount to determine the total repayment. It’s not an interest rate in the traditional sense. Factor rates are typically expressed as decimals (e.g., 1.25).

- Holdback Percentage: This represents the portion of your daily credit card sales that’s automatically deducted to repay the advance.

Unlike traditional loans with fixed monthly payments, MCAs offer a unique repayment structure. The holdback percentage is automatically deducted from your daily sales, meaning you repay the advance faster during periods of high sales and slower during slower periods. This aligns repayment with your cash flow, offering flexibility for businesses with fluctuating income.

Understanding the Cost: Factor Rates, Net Funding, and Holdbacks

One of the most significant differences between MCAs and traditional loans is the use of factor rates instead of Annual Percentage Rates (APRs). APR is a standardized measure used to compare the annualized cost of borrowing for loans. However, because MCAs are not technically loans but rather a purchase of future receivables, APR isn’t a directly applicable metric.

At 3BAdvance.com, we prioritize transparency. We focus on clearly explaining the factor rate, net funding, and holdbacks to avoid any confusion.

Here’s how these elements work together:

- Advance Amount: This is the initial approved amount. For example, you might be approved for a $100,000 advance.

- Factor Rate: This determines the total repayment amount. Using a factor rate of 1.25:

$100,000 x 1.25 = $125,000 (Total Repayment) - Net Funding: This is the actual amount you receive upfront. This is where the confusion often arises. In some cases, a portion of the approved advance is held back as a reserve or to cover initial processing. This held-back amount is not a fee but is part of the overall agreement and is factored into the total repayment calculation.

Example: You are approved for $100,000, but $20,000 is held back. Your net funding is $80,000. This is the amount you receive in your bank account. - Holdback Percentage and Repayment: The holdback percentage determines how much of your daily sales is used to repay the total repayment amount ($125,000 in our example). This means you’re repaying the full $125,000, even though you only received $80,000 upfront.

Addressing the Confusion:

It’s important to understand that you are repaying the full $125,000 based on the factor rate, even though you received $80,000 initially. The $20,000 holdback is part of the agreement and is factored into the overall cost. You are not paying back an additional $45,000. The $25,000 difference between the $100,000 approval and the $125,000 repayment is the cost associated with the factor rate.

Example Breakdown:

- Approved Advance: $100,000

- Factor Rate: 1.25

- Total Repayment: $125,000

- Holdback: $20,000

- Net Funding (Amount Received): $80,000

- Cost of Advance: $25,000 (The difference between the total repayment and the approved advance)

Transparency is Key: No Hidden Fees at 3BAdvance.com

At 3BAdvance.com, we believe in complete transparency. We don’t have hidden fees. In the rare instance where a partner lender might have fees associated with their specific product, our dedicated agents will walk you through every single detail, step-by-step, ensuring you fully understand the contract before you commit. We’re committed to providing clear explanations and answering all your questions. We will clearly explain the approved amount, net funding, holdback percentage, and total repayment amount to eliminate any confusion.

When MCAs Make Sense for Your Business

MCAs can be a valuable tool for businesses in specific situations:

- Short-Term Working Capital Needs: Covering immediate expenses, managing inventory, or addressing unexpected costs.

- Seizing Time-Sensitive Opportunities: Funding a marketing campaign, purchasing discounted inventory, or taking advantage of a limited-time offer.

- Bridging Cash Flow Gaps: Smoothing out fluctuations in revenue or covering expenses during slower seasons.

Key Benefits of Choosing 3BAdvance.com:

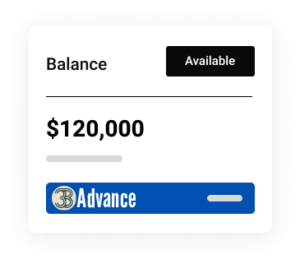

- Fast and Efficient Funding: We understand that time is of the essence. Our streamlined process ensures quick access to capital.

- Flexible Qualification Requirements: We consider various factors beyond just credit scores, focusing on your business’s overall health and potential.

- No Collateral Required: MCAs through 3BAdvance.com are unsecured, meaning you don’t need to pledge any assets.

- Transparent and Personalized Service: Our dedicated agents provide personalized support and ensure you understand every aspect of the MCA process. We walk you through the contract step by step.

- No Hidden Fees: We are committed to transparency and don’t believe in surprising our clients with unexpected charges.

Partnering with 3BAdvance.com

Choosing the right financing option can be a critical decision for your business. At 3BAdvance.com, we’re dedicated to providing transparent, accessible, and personalized service. We’ll work with you to understand your specific needs and determine if an MCA is the right fit for your business goals. Contact us today to learn more about how we can help your business thrive.